Gold margin growth yet to show

Gold prices up but so are AISCs

The March quarter gold financials are in, and are higher gold prices translating into a cash bonanza for producers? The short answer is: not yet!

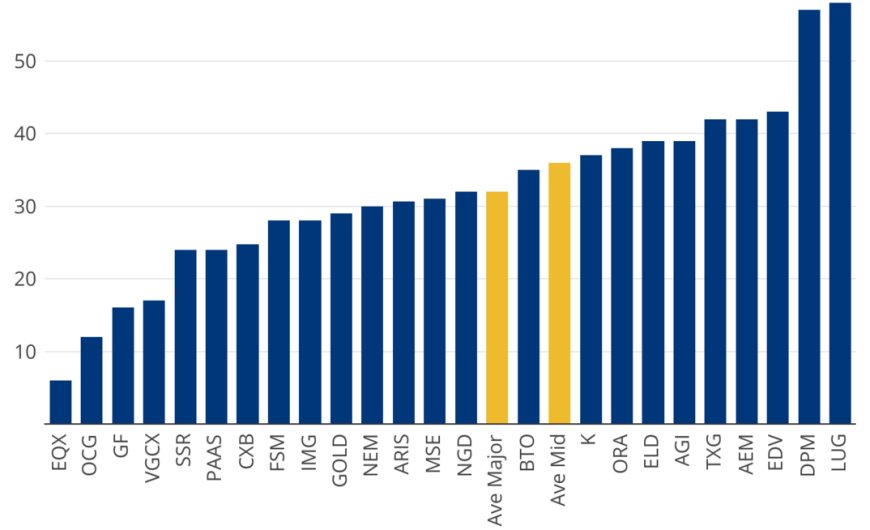

The gold majors achieved an average all-in-sustaining cost (AISC) of US$1408/oz, up 6.6% quarter on quarter and 13% over the prior year period. The average AISC margin was 32%, which is pretty much what it was throughout 2023, although it was lower than the 34% seen a year ago.

The margin standouts were Endeavour Mining at 42.6% and Agnico Eagle Mines at 42.4%, although Agnico's margin showed growth compared with 36.4% in the December 2023 quarter, while Endeavour's has shrunk from 50.3% in the prior quarter. In fact, only four of the eight majors saw margin growth. At the bottom of the pile was Gold Fields, with a margin of just 15.9%.

In terms of AISC, no major is sub $1000/oz as Endeavour's costs finally broke above this level, although it still leads the pack at $1186/oz. Panamerican Silver ($1580/oz) beat out Newmont ($1439/oz) to relieve it of the major miner AISC wooden spoon.

The picture for the mid-tiers is more positive, leading credence to the axiom that they have greater leverage to rise in the gold price. Their average AISC increased to $1414/oz, just 1.6% higher than the December 2023 quarter and 5.5% higher than a year ago. Incredibly, the gap between the average AISC of majors and mid-tiers has fallen to its lowest level since early 2019 at just $6/oz. Lundin Gold and Dundee Precious Metals have sub $1000/oz AISC.

The mid-tiers also show margin expansion, whereas the majors do not. Their average margin increased to 32% from 29% in the December quarter and 33% a year ago. Lundin Gold (58%) and Dundee Precious Metals (57.3%) are at the top of the margin class, as 11 companies saw margin improvement. However, three companies still have more work to do: Equinox Gold (5.6%), OceanaGold (11.8%) and Victoria Gold (17.3%).

In terms of production, the majors also saw a contraction in the March quarter with an aggregate output of 6.1Moz of gold equivalent, a 3.8% decline from the December 2023 quarter, although a 13.1% rise from a year ago. All producers, except for Newmont, reported lower production in the quarter compared with the December quarter; five were lower than a year ago.

The mid-tiers also feel the production pinch as output fell 16.3% from the December quarter and 12% from a year ago to 1.5Moz of gold equivalent. All but three companies (Lundin Gold, IAMGOLD and Alamos Gold) reported production declines from the last quarter, and only four showed growth year-on-year.

What's Your Reaction?